"Have a business idea? Get it going today!" That’s not just a slogan anymore. It’s the exciting new normal for entrepreneurs in today’s digital economy. The convergence of Artificial Intelligence (AI), Software-as-a-Service (SaaS), and Banking-as-a-Service (BaaS) has drastically lowered barriers to entry, empowering anyone with a vision to build and launch a product, fast.

From tools like Supabase for backend infrastructure to Replit for collaborative development and Google’s AI coding suite, creators can spin up impressive platforms, automate operations, and deploy features in days. A few years ago, this would have taken months and millions in funding.

But there’s one key area where even the leanest, AI-fueled startups can stumble, payments infrastructure.

The Rise of Lean AI-Powered Businesses

We’re witnessing an explosion of businesses launching with just a handful of people and a toolbox of APIs. What used to require massive infrastructure and deep financial resources can now be bootstrapped with a laptop and a smart tech stack.

Why This Matters:

-

SaaS for Instant Efficiency: CRM, project management, email campaigns, all covered by plug-and-play SaaS tools.

-

BaaS for Embedded Finance: From card issuing to embedded payments, BaaS providers let businesses offer financial services without a banking license.

-

AI for Smart Automation: AI is now powering product descriptions, customer support, data analysis, and even marketing campaigns. McKinsey reports that generative AI could add up to $4.4 trillion annually to the global economy (McKinsey, 2023).

With these tools, a team of two can build what used to take a corporation. But that speed exposes a hidden complexity.

Where Startups Hit the Wall: Payment Infrastructure

While platforms like Stripe or Adyen help with basic payment needs, many fast-scaling businesses soon discover that payment complexity grows fast, and quietly eats away at margins, efficiency, and trust.

Common Pitfalls:

-

Opaque Pricing: Promised low rates often hide interchange, statement, chargeback, and batch fees. According to The Nilson Report, global merchants lost $165 billion to fees in 2023 alone.

-

Integration Friction: AI platforms often rely on custom workflows. Many providers offer generic SDKs that require costly workarounds and time-consuming manual steps.

-

Compliance Risk: PCI DSS, KYC, AML, regulatory headaches that few startups are prepared to handle. A breach or misstep can bring fines, lost trust, or worse.

-

Scalability Issues: What works for 1,000 transactions might fail at 10,000. Few payment providers are built to scale efficiently alongside AI-fueled businesses.

-

Unresponsive Support: When chargebacks hit or fraud occurs, most platforms offer generic help. What you need is tailored support that understands your model and risk exposure.

These problems are especially acute for AI startups moving fast. That’s where a fintech ally like TCB Pay changes the game.

How TCB Pay Powers High-Growth, AI-Driven Startups

At TCB Pay, we specialize in supporting ambitious startups with transparent, scalable, and secure payment solutions designed to grow alongside your business.

Why We’re Different:

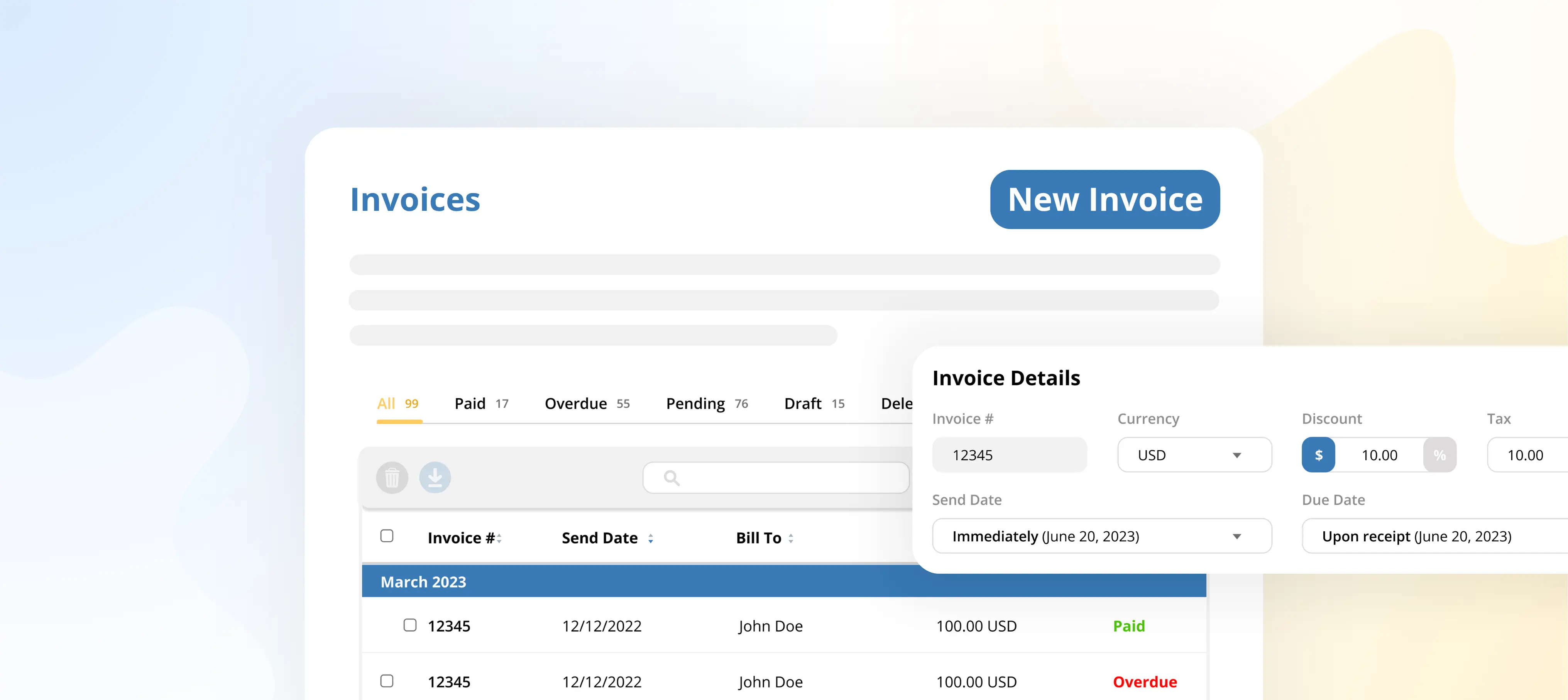

1. Seamless API Integrations

-

Issuing API: Instantly generate virtual and physical corporate cards with spending rules, real-time controls, and automated workflows. Ideal for ad budgets, affiliate payouts, or employee expenses.

-

Credit Card & Gateway APIs: Accept global payments across currencies with built-in fraud detection and next-day settlement. Fully embeddable in your product.

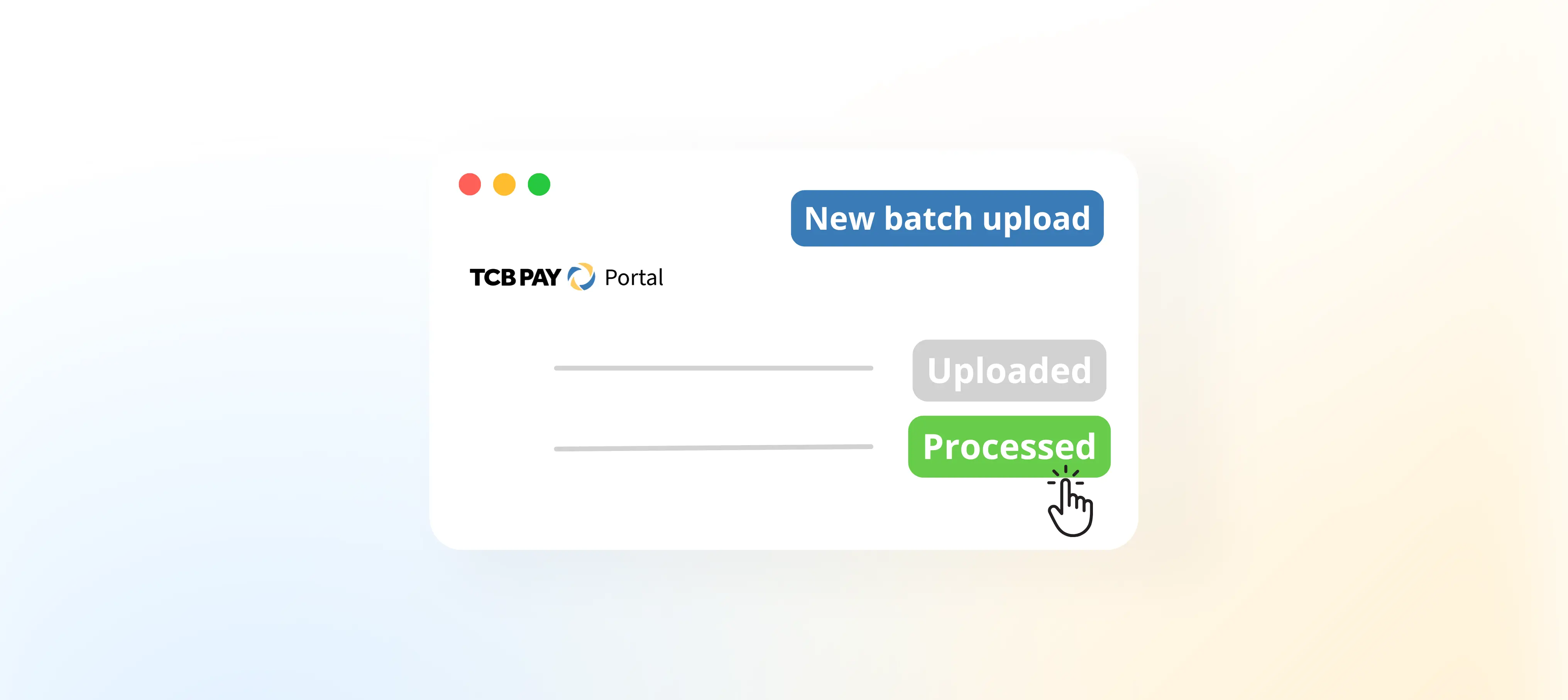

Explore more on this in our Batch Capture Feature Guide for faster processing and better control.

2. Transparent Pricing Model

-

No hidden fees. Ever.

-

Real-time reporting and clean reconciliation.

-

Predictable margins, even during high-growth periods.

3. Enterprise-Grade Security

-

AI-enhanced fraud detection and risk scoring

-

Full compliance with PCI DSS and KYC/AML standards

-

Dispute management built-in

4. Built to Scale

Whether you're handling 10 or 10 million transactions a month, our infrastructure adjusts without disruption. TCB Pay is designed for hyper-growth companies that need stability, flexibility, and speed.

5. Real Support from Real People

When something goes wrong, you speak with payment experts who know your setup, not a generic chatbot or support script.

Don’t Let Payments Stall Your Growth

The age of AI-first businesses is just beginning. With tools that reduce time to market from months to days, there’s never been more opportunity. But fast innovation needs solid financial infrastructure, otherwise, the most brilliant ideas stall out.

With TCB Pay, payments no longer have to be a silent bottleneck. Instead, they become a scalable advantage, helping you automate, monetize, and grow, without compromise.

Back to all articles

Back to all articles

Free Demo with Chris

Free Demo with Chris