Every business owner knows the obvious costs of running a company—inventory, salaries, rent—but what about the costs you don’t see? Specifically, the hidden expenses that come from relying on outdated payment systems? If you haven’t upgraded your payment processor in a while, you might be leaving money, time, and customers on the table without even realizing it. Let’s dive into the invisible price you’re paying.

Today’s customers expect fast, flexible, and diverse payment options. If your system doesn’t accept contactless payments, mobile wallets, or even alternative methods like buy-now-pay-later, you could be alienating potential buyers. Studies show that 17% of shoppers abandon their cart when their preferred payment method isn’t available. Multiply that by hundreds or thousands of transactions a year, and you’re looking at a significant revenue drain.

Older payment systems often lack advanced cost-management tools, meaning you’re likely paying higher processing fees. Modern payment processors can help you optimize transaction routing, use fee-lowering strategies, and even offer flat-rate models that save money. Without these innovations, you might be overspending by thousands annually.

Hackers love outdated technology. Older systems are more vulnerable to data breaches and fraud, which can cost your business in both fines and reputation damage. Newer payment systems come with robust encryption, tokenization, and AI-driven fraud detection that offer better protection for you and your customers.

Imagine a customer at your counter or checkout page facing slow processing times or declined transactions because your system can’t keep up. Frustrated customers don’t just walk away; they take their loyalty elsewhere. A seamless payment experience is no longer a bonus—it’s a baseline expectation.

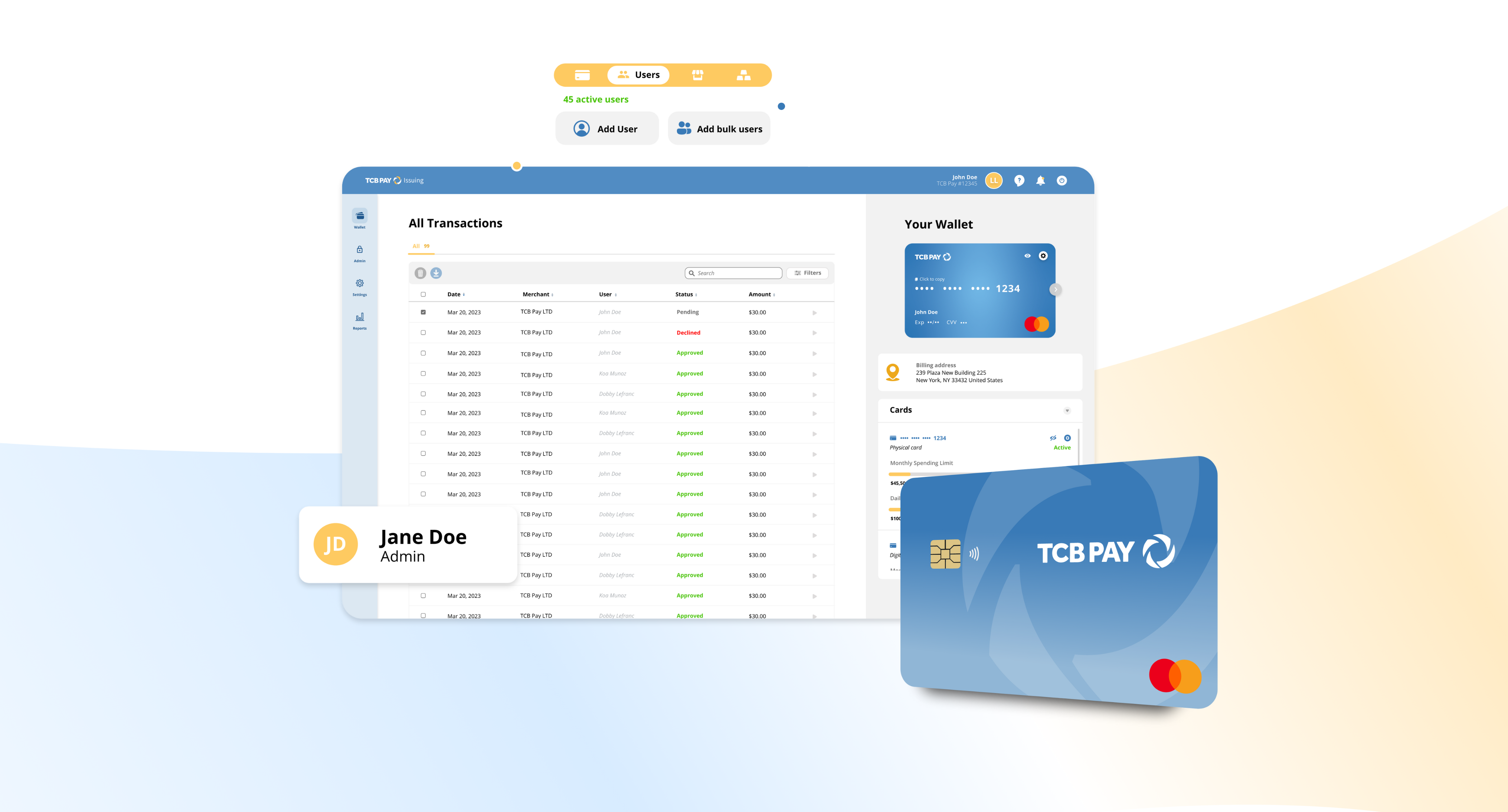

Modern payment systems do more than process transactions; they provide actionable data. From identifying peak sales periods to understanding customer behavior, analytics tools can help you make smarter business decisions. Sticking with an outdated system means missing out on insights that could fuel your growth.

Older systems often lack automation features, forcing you or your team to spend hours reconciling payments, managing refunds, or manually updating records. Time is money, and those hours could be better spent growing your business.

As your business grows, so do your payment needs. Outdated systems might struggle to handle higher transaction volumes, multiple locations, or international currencies. Upgrading ensures your payment processor scales with your ambitions.

Upgrading to a modern payment processor isn’t just a technical decision; it’s a strategic investment. The latest systems offer speed, security, flexibility, and invaluable data insights that drive business success. By staying current, you reduce hidden costs and create a better experience for both your customers and your team.

At TCB Pay, we specialize in helping businesses of all sizes modernize their payment solutions. With cutting-edge fraud protection, seamless integrations, and transparent pricing, we transform your payment processing into a competitive advantage. Don’t let hidden costs hold you back. Explore TCB Pay today and watch your business thrive!