All posts

Dynamic pricing; How companies are rethinking to fuel the next wave of growth

Posted on 12/29/2025

Visa’s VAMP Signals a New Era for High-Risk Merchants

Posted on 11/24/2025

How Small Businesses Win with Customer Support

Posted on 11/17/2025

Thanksgiving 2025: A Strategic e-Commerce Playbook for Retailers

Posted on 11/12/2025

Cyber Monday: what business owners need to know

Posted on 11/10/2025

5 Holiday Strategies Every Small Business Should Try Before Year-End

Posted on 11/06/2025

How to Prepare Your Business for Black Friday 2025

Posted on 11/03/2025

How Businesses Can Win Big This Halloween

Posted on 10/27/2025

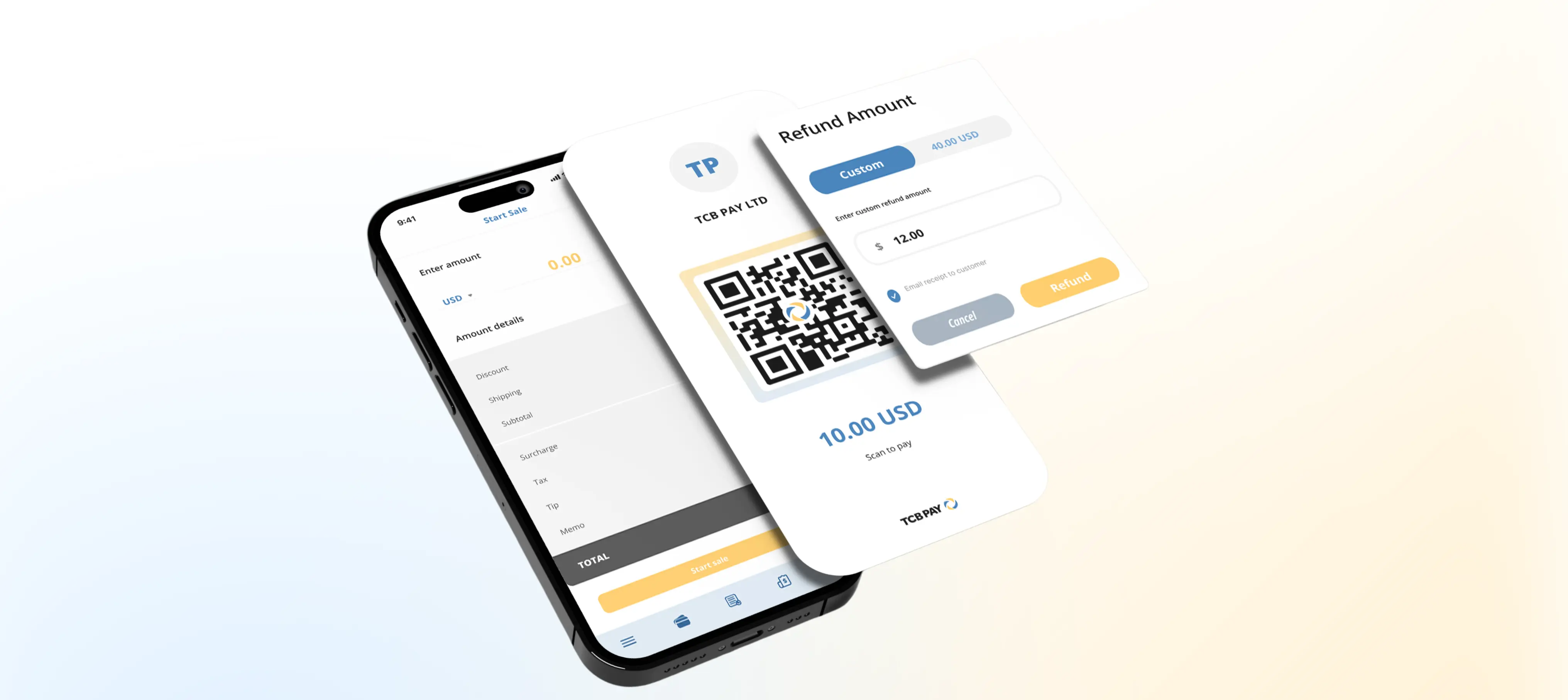

Now Live: The TCB Pay App Is Here to Simplify Your Payment Life

Posted on 10/21/2025