Still wasting hours on manual underwriting? You’re already behind.

As fraud gets smarter and merchants expect instant approvals, AI underwriting is no longer a luxury—it’s the standard. For fintechs and ISOs looking to scale fast without sacrificing compliance or accuracy, automation is the only way forward.

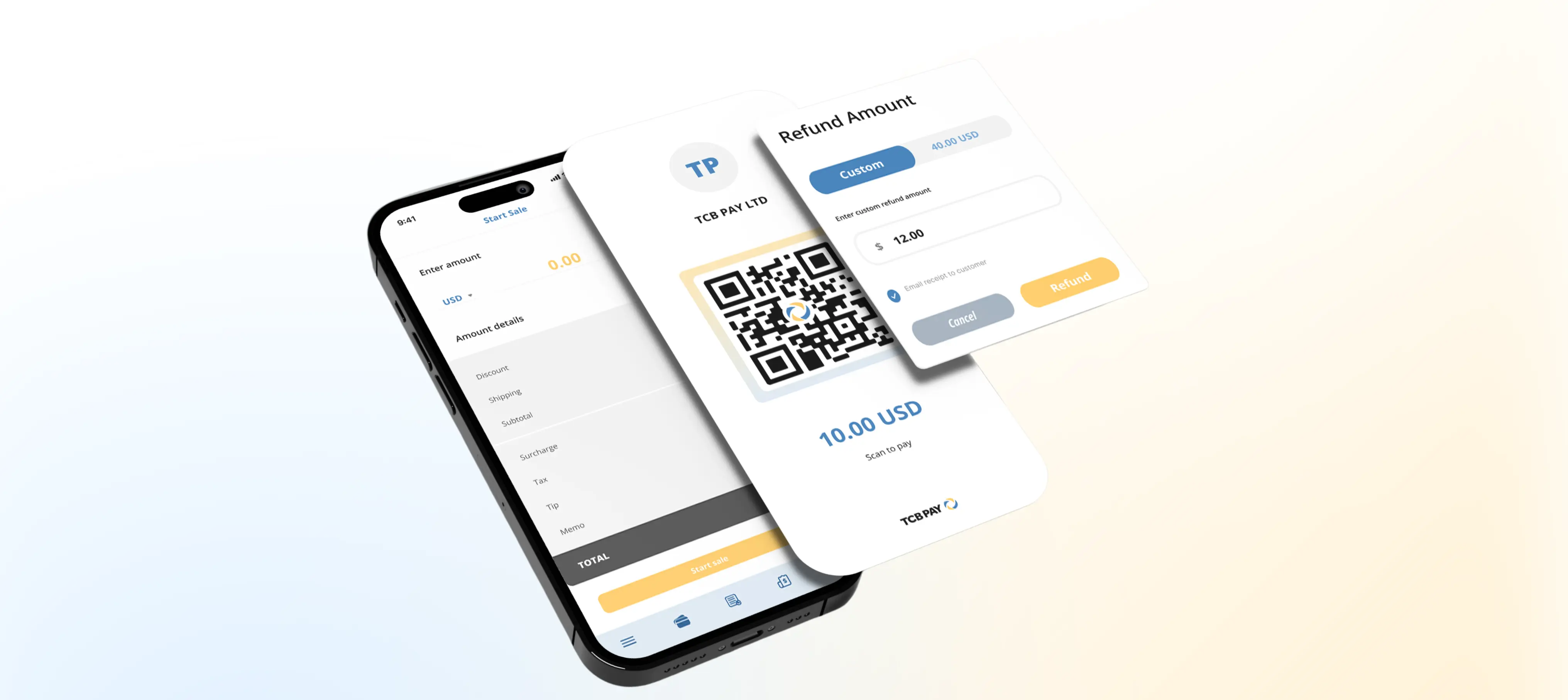

From real-time risk modeling to automated KYC checks, AI is rewriting the rules of merchant onboarding and risk management. Forward-thinking companies like TCB Pay are already leading the shift—are you keeping up?

Why Traditional Underwriting Falls Short

Conventional underwriting requires human analysts to manually review merchant applications, financial statements, and business documents. This process is:

-

Time-consuming: slowing down merchant onboarding

-

Error-prone: especially when handling large volumes of data

-

Subject to bias: risking inconsistencies in risk evaluation

As fraud becomes more complex and merchant demand increases, these limitations can cripple growth.

At TCB Pay, we’ve seen firsthand how outdated underwriting slows down approval cycles, especially in high-risk verticals. That’s why modernizing this process is more than a trend—it’s a necessity.

How AI Is Revolutionizing Underwriting

AI-driven underwriting automates decision-making, enhances accuracy, and enables real-time responsiveness. Here’s how fintechs and ISOs are using AI to their advantage:

1. Instant Application Processing

AI tools extract and analyze data from merchant applications instantly—including credit history, processing volume, and banking details—reducing approval times from days to minutes.

2. Predictive Risk Modeling

Machine learning algorithms assess the likelihood of fraud, chargebacks, or default using behavioral and historical data. These models are self-improving and offer far more precision than static risk rules.

3. Document Intelligence (OCR + NLP)

AI-powered Optical Character Recognition (OCR) and Natural Language Processing (NLP) tools can read and validate scanned documents or handwritten forms. This ensures standardization while removing manual entry errors.

4. Automated Compliance and KYC

AI systems streamline KYC, AML, and global watchlist checks. Applications are screened in real-time against databases like OFAC, PEPs, and sanction lists, flagging suspicious profiles immediately.

5. Post-Onboarding Monitoring

AI doesn’t stop at approval. It continues to track merchant behavior in real time, identifying anomalies, fraud signals, or transaction spikes to recalibrate risk scores dynamically.

Benefits of AI for Fintechs and ISOs

-

Speed: Accelerates merchant approvals with real-time decisions

-

Accuracy: Reduces underwriting mistakes and improves fraud detection

-

Scalability: Handles thousands of applications simultaneously

-

Adaptability: Learns and evolves with changing fraud patterns and regulations

Companies like TCB Pay leverage these AI tools to offer a more agile, scalable underwriting process—particularly valuable when working with hard-to-place merchants or niche industries.

The Role of Humans in an AI-Driven Underwriting Future

AI isn’t replacing underwriters—it’s empowering them. By automating repetitive tasks, surfacing deep insights, and continuously learning, AI enables underwriting teams to focus on nuanced cases and strategic oversight.

As AI adoption becomes the norm, fintechs and ISOs that embrace this evolution—like TCB Pay—will lead the industry in faster onboarding, smarter risk mitigation, and operational excellence.

Back to all articles

Back to all articles