The SWIFT code, also called SWIFT/BIC is the global identifier that routes money to the correct financial institution during a cross-border transfer. It is managed by the Society for Worldwide Interbank Financial Telecommunication and defined in the ISO 9362 standard. SWIFT connects 11,500+ institutions across 224 countries and territories and processes an average of 53.3 million FIN messages per day, with about 90% of payments reaching destination banks within one hour.

Want to go deeper into cross-border flows and business banking setup See our Payment Processing overview.

Where Can I Find My SWIFT/BIC

- On bank statements or account details in your online banking

- In the international transfers section of your mobile app

- On your bank’s website FAQ or help pages

- By contacting customer support or visiting a branch

- In trusted directories that reference the official BIC database maintained by SWIFT, the ISO Registration Authority for ISO 9362.

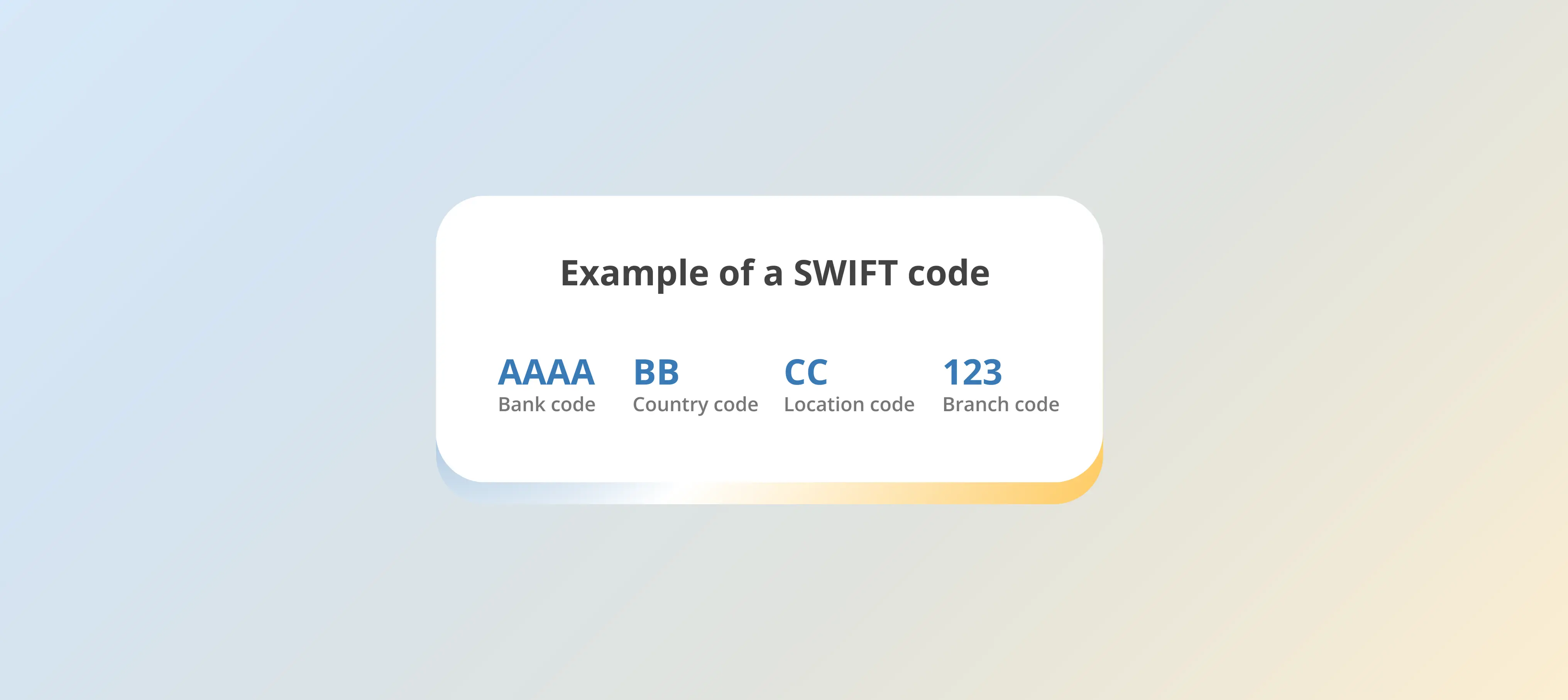

What Is The Format of a SWIFT/BIC

A SWIFT/BIC is 8 to 11 characters that identify a bank and optionally a branch. The structure is defined by ISO 9362.

- Bank code 4 letters

- Country code 2 letters

- Location code 2 letters or digits

- Branch code 3 letters or digits optional

Example DEUTDEFF identifies Deutsche Bank in Germany. ISO confirms this format and purpose for automated processing and routing.

What Is The Purpose of a SWIFT Code

The SWIFT/BIC identifies the receiving institution and enables secure, standardized messaging between banks so funds are routed accurately and processed quickly. It supports international trade, remittances, and cross-border ecommerce where speed and predictability matter. SWIFT reports global reach across 40,000+ payment routes and 4 billion+ accounts.

How Do Banks Obtain A SWIFT/BIC

SWIFT is the ISO Registration Authority that allocates and issues BICs under ISO 9362. Institutions apply through SWIFT and follow the BIC Registration Procedures.

Are SWIFT Codes The Same Worldwide

No. BICs are unique to each institution and sometimes to each branch. Even banks in the same country may have different BICs depending on location or business unit.

Can A SWIFT Code Change

Yes. Mergers, restructuring, or rebranding can trigger a BIC update. Always verify a recipient’s SWIFT/BIC before sending money especially if anything has recently changed. SWIFT’s BIC policy and registration procedures govern updates and legacy protection.

What’s The Difference Between SWIFT and IBAN

- SWIFT/BIC identifies the bank or financial institution ISO 9362

- IBAN identifies the individual account at that bank format defined outside ISO 9362 and used mainly in Europe and other IBAN-adopting regions

Transfers often require both so funds reach the right bank and the right account.

Ready To Improve Your Cross-Border Setup

Modern payments need speed transparency and fraud controls. SWIFT is also moving the ecosystem toward richer data with ISO 20022 messages and new rules for faster predictable retail cross-border flows.

- TCB Pay Payment Processing accept cards wallets and international payments with strong risk tools

- TCB Pay Issuing create virtual cards for global vendors and controlled spend

- TCB Pay Reimbursements streamline payouts to teams and suppliers

Back to all articles

Back to all articles

Free Demo with Chris

Free Demo with Chris