The payments industry is evolving rapidly, driven by technology and shifting consumer expectations. What was once cutting-edge—like AI-driven security, biometric authentication, and embedded finance—is now becoming standard. In 2025, businesses and consumers will experience:

Seamless transactions that reduce checkout friction

Advanced security powered by AI and biometrics

Innovations in digital currencies like stablecoins and CBDCs

For business owners, fintech professionals, and anyone valuing transaction efficiency, staying informed on these trends is essential to thrive in the changing financial landscape.

Artificial intelligence (AI) and machine learning (ML) are transforming the payments industry, especially in fraud detection. With payment fraud losses projected to exceed $40.6 billion by 2027, businesses are turning to AI-powered security measures to detect fraud in real-time. For example:

Visa’s AI tools block an estimated $25 billion in fraudulent transactions annually.

AI-powered systems help businesses combat fraud as digital transactions outpace cash payments.

Beyond security, AI personalizes payment options, creating experiences tailored to consumer habits. Through machine learning algorithms, businesses can offer:

Buy Now, Pay Later (BNPL) options

Instant credit approvals and subscription-based payments

With 91% of consumers preferring personalized experiences, AI-driven solutions, are becoming essential for businesses seeking to enhance customer engagement.

Embedded finance integrates financial services directly into non-financial platforms, making transactions seamless. Whether it's e-commerce, healthcare, or B2B services, embedded finance simplifies the checkout process and enhances user experience. The embedded finance market, valued at $2.6 trillion in 2021, is projected to reach $7.2 trillion by 2028.

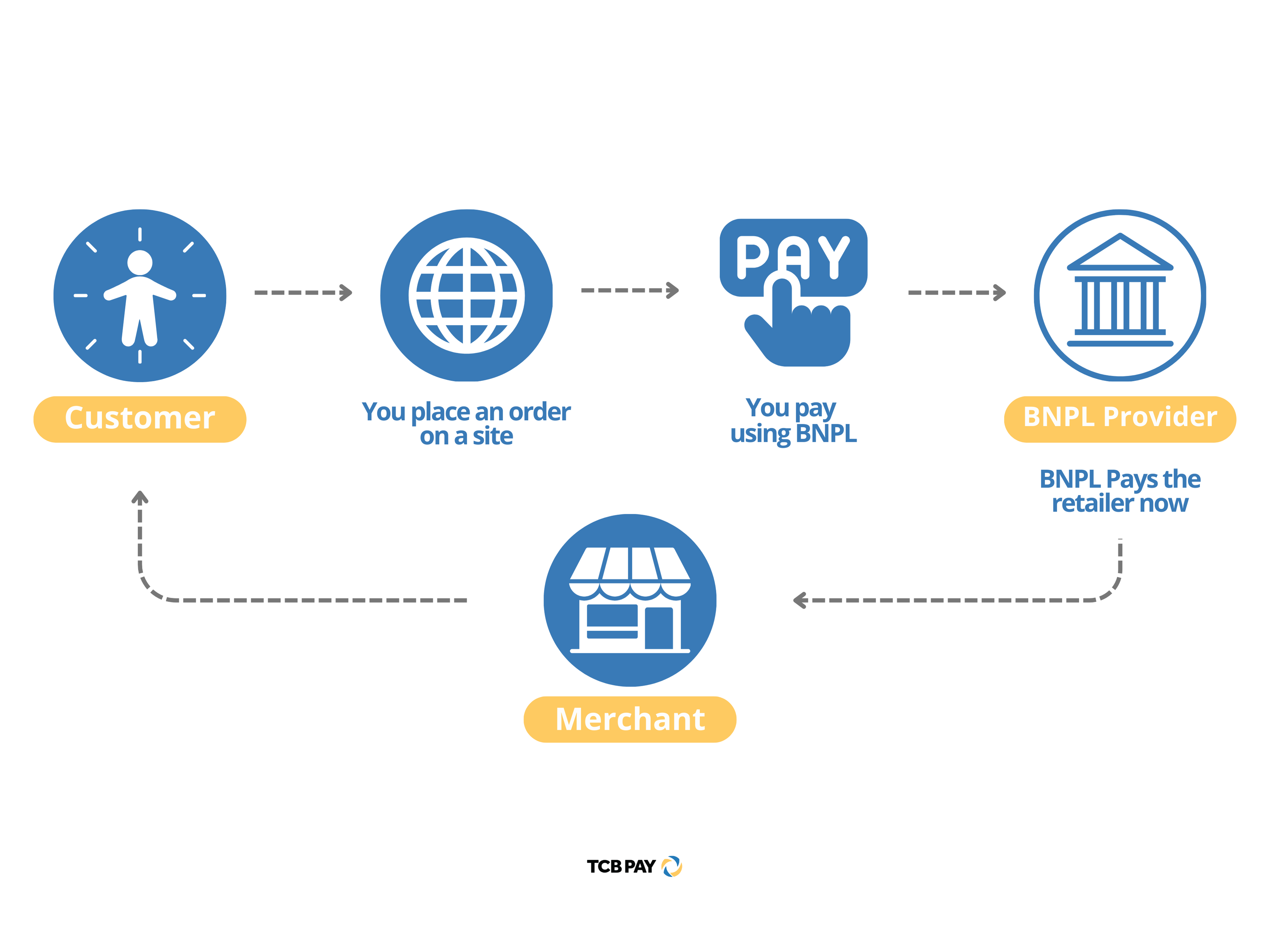

A major driver of this growth is the expansion of BNPL services, which have moved beyond retail into sectors like healthcare and B2B transactions. By 2026, the BNPL market is expected to handle over $576 billion in transactions. Companies like Shopify report that offering BNPL options:

Reduces checkout times by 60%

Boosts conversion rates significantly

This shows that flexible payment solutions are more than just a trend—they're a necessity for modern commerce.

Cryptocurrencies and Central Bank Digital Currencies (CBDCs) are reshaping global payments. Over 130 countries, representing 98% of global GDP, are exploring CBDCs. Key developments include:

China's digital yuan pilot programs

The European Central Bank's plans for a digital euro

Meanwhile, stablecoins offer a more stable alternative to volatile cryptocurrencies. Companies like PayPal have launched stablecoins (e.g., PYUSD) to facilitate:

Instant, low-cost digital payments

Streamlined international transactions

As regulations for digital assets become clearer, the adoption of CBDCs and stablecoins will grow, integrating them into daily financial activities.

Biometric authentication is replacing traditional passwords and PINs, making transactions both faster and more secure. By 2025, over 3 billion people will use biometric payments, including:

Fingerprint scans, facial recognition, and palm-based authentication

Innovations like Amazon’s palm-scanning technology

Voice-activated payments are also on the rise. According to Juniper Research, voice commerce transactions will exceed $19.4 billion by 2025, driven by smart assistants and mobile voice technology.

Modern businesses need payment solutions that are more than just transactional—they must offer efficiency, security, and flexibility. Instead of generic platforms, companies are turning to customized systems like those from TCB Pay, designed to handle:

High transaction volumes and recurring payments

Multi-channel sales with credit cards, ACH payments, and digital wallets

With AI-driven fraud prevention and real-time transaction monitoring, businesses can protect revenue, reduce chargebacks, and scale efficiently in an increasingly digital landscape.