Corporate cards have long been a fixture in business finance, but for decades, they functioned in largely the same way: a payment tool with little visibility, requiring cumbersome reconciliation at the end of each billing cycle. Today, fintech is reshaping the role of corporate cards, transforming them from passive spending instruments into proactive financial management tools.

With businesses seeking greater control, automation, and real-time financial insights, fintech-powered corporate cards are offering solutions that go beyond transactions. These modern cards provide automated expense tracking and real-time data analytics, enabling businesses to optimize spending, reduce financial inefficiencies, and improve compliance.

In a 2023 PwC CFO survey, 89% of finance leaders stated that they are prioritizing digital transformation in financial operations, with automation and real-time analytics being key areas of focus. This shift reflects the growing demand for smarter, more agile financial tools—a demand that corporate card technology is increasingly addressing.

Traditional corporate cards posed a number of challenges for businesses:

Fintech-driven corporate cards are solving these challenges with technology-driven solutions that enable businesses to manage expenses more effectively. Modern corporate cards now offer:

Transactions are instantly recorded, categorized, and synced with expense management systems, reducing the need for manual data entry and reconciliation. This automation eliminates common errors and frees up valuable time for finance teams.

Finance teams can set limits on transactions by merchant, category, amount, or time of day, reducing unauthorized spending and improving budget adherence. This level of control is particularly useful for businesses with frequent employee travel, vendor payments, or departmental budgets to manage.

As businesses increasingly rely on digital tools and SaaS platforms, virtual cards provide an extra layer of security and control. Companies can issue unique virtual cards for specific vendors, set expiration dates, and track spending at a granular level. This prevents subscription creep and reduces the risk of fraud.

Unlike traditional corporate cards, which require finance teams to compile data manually, fintech-enabled cards provide instant visibility into spending patterns. Finance leaders can analyze trends, forecast cash flow needs, and make data-driven financial decisions without waiting for end-of-month reports.

Cost Reduction: The integration of fintech solutions has led to more efficient processes and reduced operational costs, democratizing access to financial services. (Research Gate)

Increased Efficiency: Fintech innovations have streamlined operations, allowing financial institutions and lenders to automate routine tasks, thereby reducing manual efforts and associated errors. (Blog Repay)

Enhanced Risk Management: The adoption of fintech solutions, such as blockchain technology, has improved security measures, reducing the risk of fraud and enhancing overall risk management.

For businesses of all sizes, this means fewer administrative burdens, faster decision-making, and greater financial control. By eliminating manual expense management and enhancing visibility, finance teams can shift their focus toward higher-value strategic initiatives.

At TCB Pay, we recognize that corporate cards should do more than just facilitate transactions—they should serve as a key component of a business’s financial strategy. Our corporate card solutions are designed to provide:

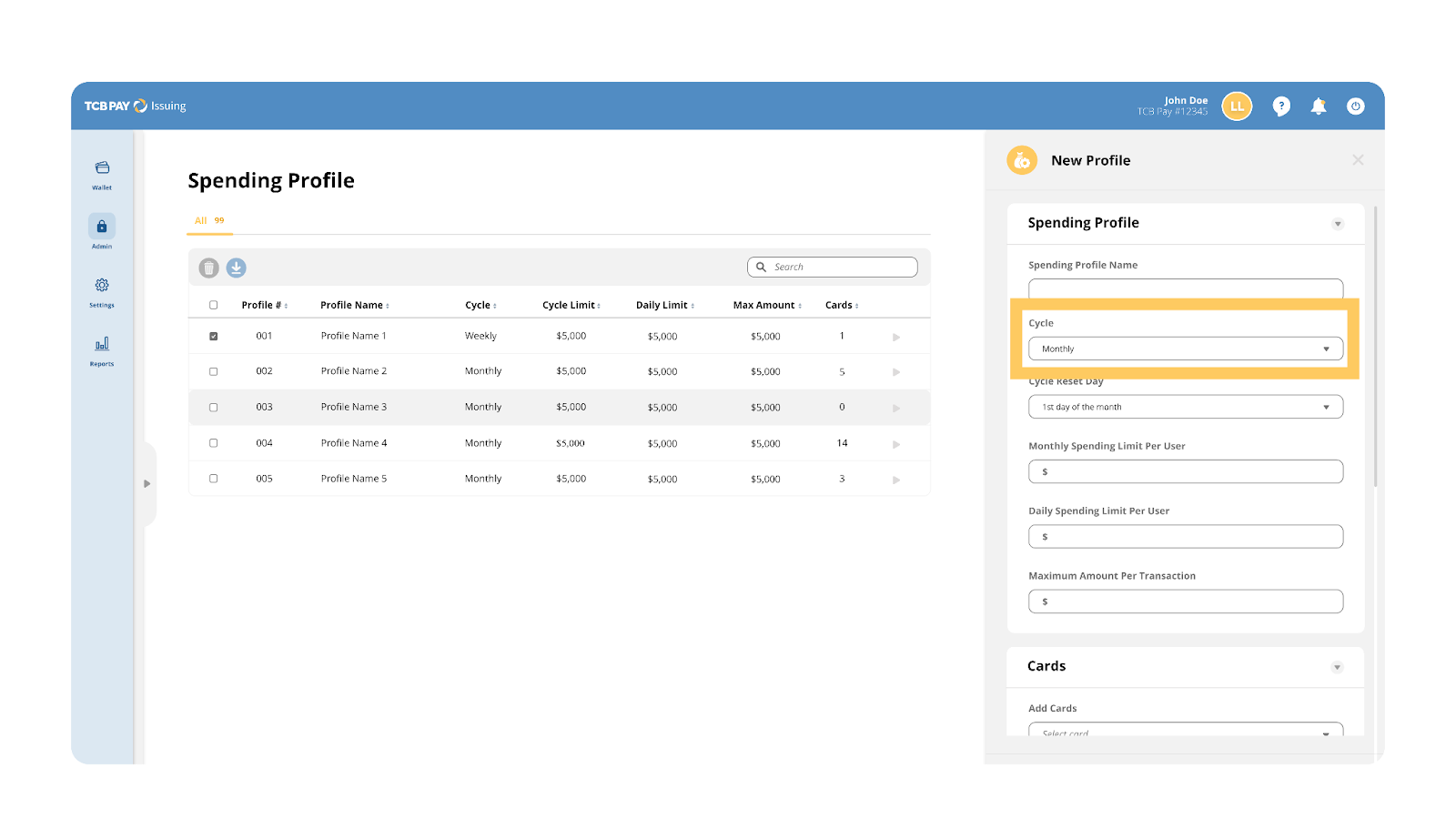

Granular Spend Controls: Businesses can define and enforce spending rules, ensuring that expenses align with budgets and policies.

Instant Virtual Cards: Secure, track, and manage online subscriptions and vendor payments without relying on a single physical card.

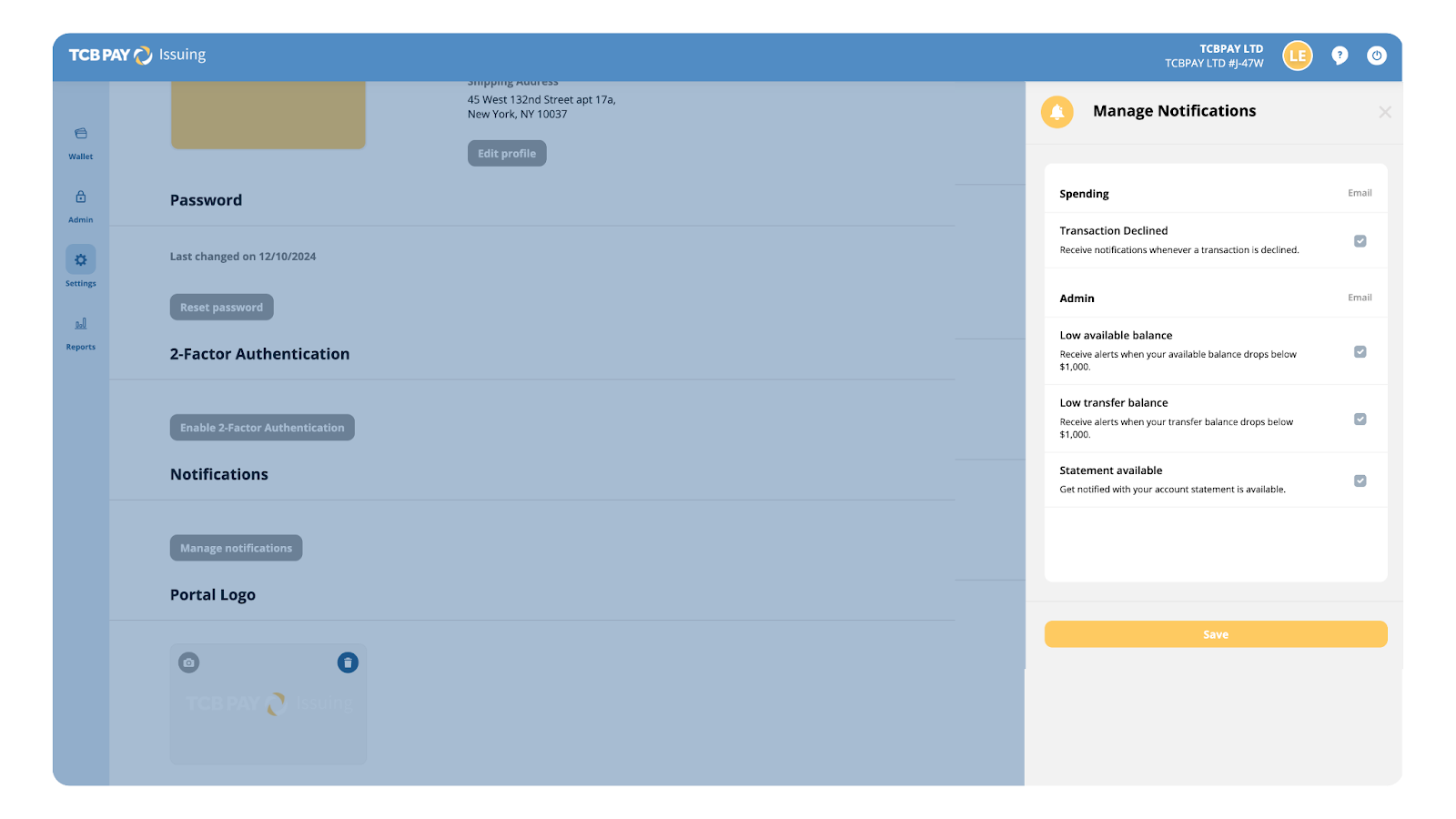

Real-Time Data Insights: Access up-to-the-minute transaction data, allowing finance teams to make informed decisions on the go.

Seamless Integrations: Sync transactions automatically with your existing financial tools for a streamlined workflow.

With the right corporate card solution, businesses no longer need to rely on outdated processes that drain time and resources. Instead, they can leverage fintech-driven tools that enhance efficiency, improve security, and drive smarter financial decision-making.

Corporate cards are no longer just a method of payment—they have become a critical financial tool that enables businesses to manage spending with greater accuracy and control. As fintech continues to drive innovation, companies that embrace smart, automated corporate card solutions will gain a competitive edge in managing their finances efficiently.

For businesses looking to upgrade from traditional, reactive expense management to a proactive, data-driven approach, the shift to fintech-powered corporate cards is not just an option—it is a necessity.