When it comes to payment processing, most businesses think they're covered—until something goes wrong. A sudden transaction failure, a mysterious fee, or a sluggish payout delay is all it takes to realize you might not be asking the right questions.

The truth? The best time to evaluate your payment provider isn’t after a problem—it's before one. Whether you're choosing a new provider or re-evaluating your current one, these seven questions can uncover hidden issues, reduce costs, and future-proof your revenue flow.

1. What are all the fees—and are they transparent?

Searches like: "payment processor fees explained", "hidden fees in merchant services"

It’s easy to get lured in by low headline rates. But payment processing fees often come with layers of hidden costs—interchange fees, gateway fees, monthly minimums, PCI compliance charges, and more. Ask for a full fee breakdown and watch for vague terms like “miscellaneous” or “account maintenance.”

2. How do you handle failed transactions?

Searches like: "how to reduce payment declines", "what happens when a card is declined?"

Declined transactions don’t just mean lost revenue—they erode trust and damage customer experience. Your provider should have tools like cascading payments, retry logic, or smart routing to maximize approval rates.

3. What is your support like—and is it 24/7?

Searches like: "best payment processor customer service", "support for merchant accounts"

When your payment system goes down, you need answers fast. Ask:

-

Is support available 24/7?

-

Is it live chat, phone, or email only?

-

Do I get a dedicated rep or just a ticket number?

4. Do you support high-risk or complex industries?

Searches like: "payment processors for high-risk businesses", "how to get approved for merchant account"

If you operate in high-risk industries (CBD, supplements, digital goods, travel, etc.), you need a provider that won’t flag every transaction or shut you down without warning. Ask if they support your MCC code, and what their risk monitoring looks like.

5. Can I accept multiple payment methods?

Searches like: "how to accept ACH, cards, and Apple Pay", "best payment options for small business"

Modern customers want choice—credit cards, ACH, Apple Pay, Google Pay, BNPL, crypto, and more. Your provider should offer an omnichannel payment solution that supports current and emerging methods.

6. How fast are payouts—and can I customize them?

Searches like: "how long does it take to get paid by Stripe/Square/PayPal?"

Your cash flow depends on when funds hit your account. Some providers hold funds longer than necessary. Ask:

-

What is the settlement schedule?

-

Can I choose instant payouts or next-day funding?

-

Are there fees for faster access?

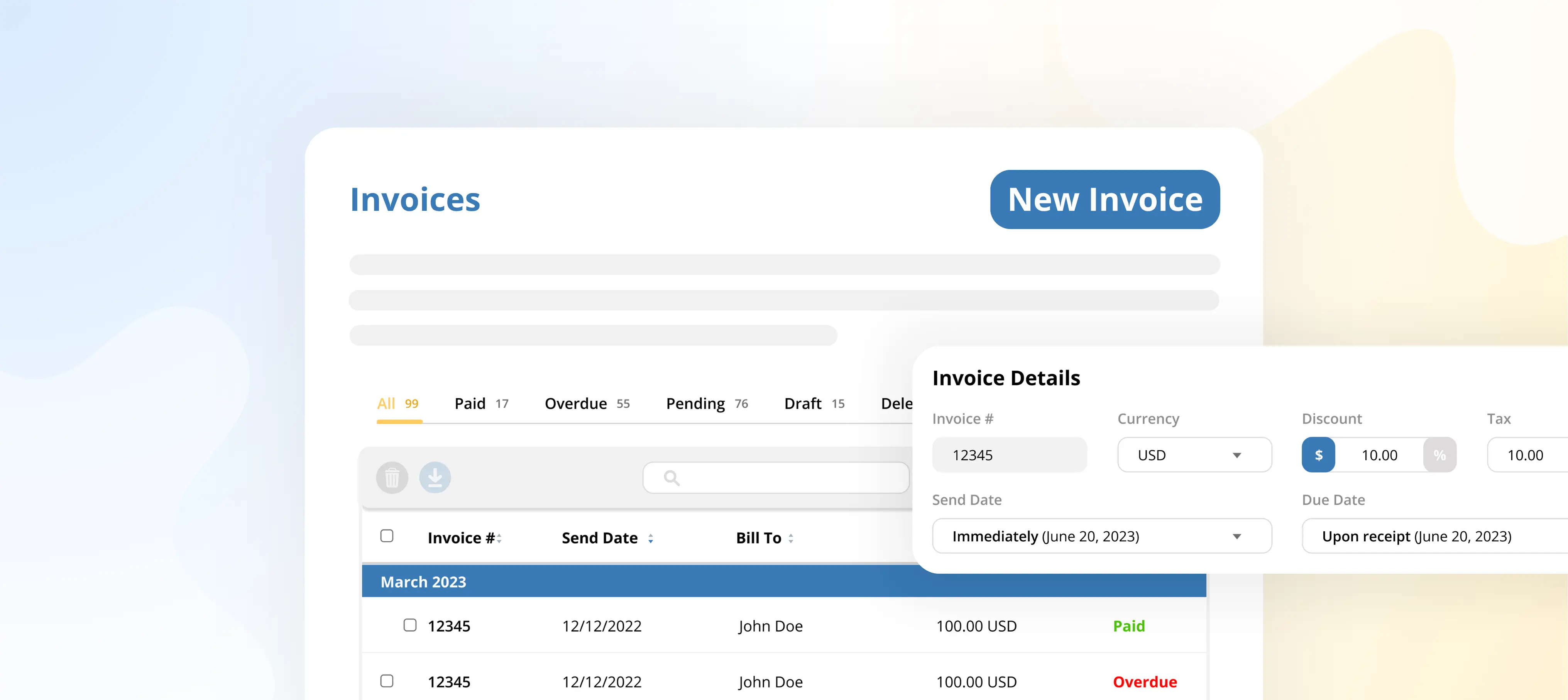

7. What reporting and insights do I get?

Searches like: "best dashboard for payment analytics", "track failed transactions and chargebacks"

A great provider gives you real-time dashboards, exportable reports, and access to transaction-level data. You should be able to track:

-

Approval rates

-

Chargeback ratios

-

Refunds

-

Revenue by payment method

A payment provider shouldn’t just move money from A to B. The right one can help you improve conversion rates, reduce costs, and create a better customer experience.

Asking the right questions is how you move from “just another merchant” to a partner with leverage.

Want a payment partner who actually answers these questions?

TCB Pay works with businesses of all sizes—from high-growth startups to high-risk verticals—to deliver custom, transparent, and flexible payment solutions. Book a free consultation or download our 2025 Payment Playbook to learn more.

Back to all articles

Back to all articles

Free Demo with Chris

Free Demo with Chris