For years, pricing was treated as a back-office exercise, a spreadsheet, a static list, a decision made once and rarely revisited. But the rules of growth are changing. Across industries, executives are realizing that pricing is no longer just an operational detail. It’s becoming a frontline strategy.

Why Pricing Is Being Rethought Now

Markets are moving faster than ever. AI adoption is reshaping how products are built, inflation is pressuring customer expectations, and regional differences in purchasing power are widening. Nearly 65% of executives admit their pricing model risks falling behind the pace of change (Stripe, 2025).

High-growth companies are already adapting: they are three times more likely to update their pricing within two years compared to slower-growth peers (Stripe Pricing Trends Report, 2025). In sectors like travel, dynamic pricing has delivered a 22% revenue lift and a 17% cut in response times (Arxiv, 2024), proving just how powerful adaptability can be at scale.

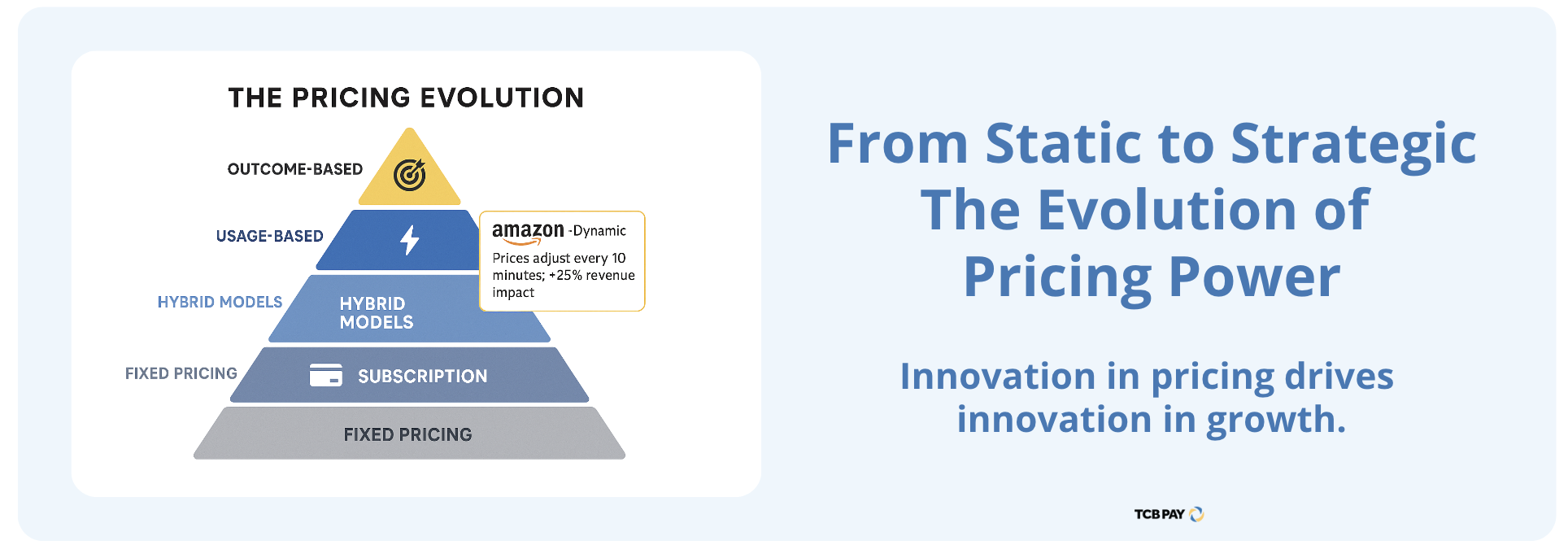

The Shift From Static to Dynamic

The old “set it and forget it” approach is being replaced by flexible models. Subscriptions are merging with usage-based elements, customers are paying for outcomes rather than access, and pricing is increasingly tailored to local conditions.

This isn’t theoretical, it’s happening now. 91% of high-growth companies adjust their usage-based pricing after launch, compared to just 75% of slower-growth firms (Stripe Pricing Trends Report, 2025). Companies adopting hybrid models that combine recurring and variable elements report 11% faster revenue growth than those using fixed-only approaches (BCG, 2023).

Example: Amazon’s Dynamic Pricing in E-Commerce

Amazon shows the power of flexible pricing at scale. Its algorithms adjust product prices as often as every 10 minutes, based on competitor pricing, demand trends, and inventory levels (Pricefy, 2024). This strategy is estimated to boost Amazon’s revenue by 25% (Fetcherr, 2024).

The takeaway: when executed with data and automation, dynamic pricing becomes more than a revenue lever — it becomes a competitive moat.

The Hidden Challenges

Adopting flexible pricing also brings complexity. Forecasting revenue is harder, finance and sales teams must stay aligned, and customers expect clarity even as back-end models grow more sophisticated.

Industry research highlights the risks. PwC’s Pulse Survey on CFO priorities notes that finance leaders increasingly cite complexity in reporting and value extraction as major challenges (PwC, 2024). At the same time, Gartner warns that poorly managed or opaque pricing practices can erode customer trust, which in turn drives higher churn rates (Gartner via Consumer Goods, 2024).

The Future of Growth Is Pricing Agility

Looking ahead, the winners won’t just be those with strong products or creative marketing, they’ll be the companies that treat pricing as a living, breathing lever for growth.

McKinsey’s research shows that companies leading in pricing agility grow 80% faster than those lagging behind (McKinsey, 2023). By 2027, nearly 40% of B2B SaaS firms are expected to adopt hybrid pricing as their standard model (IDC, 2024).

Companies are rethinking pricing, and in doing so, they’re redefining growth itself. The message is clear: the businesses that embrace pricing agility today will set the pace for tomorrow.

Back to all articles

Back to all articles

Free Demo with Chris

Free Demo with Chris