By 2026, payments are no longer a background function. They are infrastructure. For businesses that scale fast, operate across borders, or work in regulated or high-risk environments, payment systems now influence speed, cash flow, compliance, and even customer trust.

The biggest shift is not a single technology. It is the expectation that payments should work instantly, intelligently, and invisibly across the entire business.

Here are the payment trends shaping 2026 and what they mean in practice.

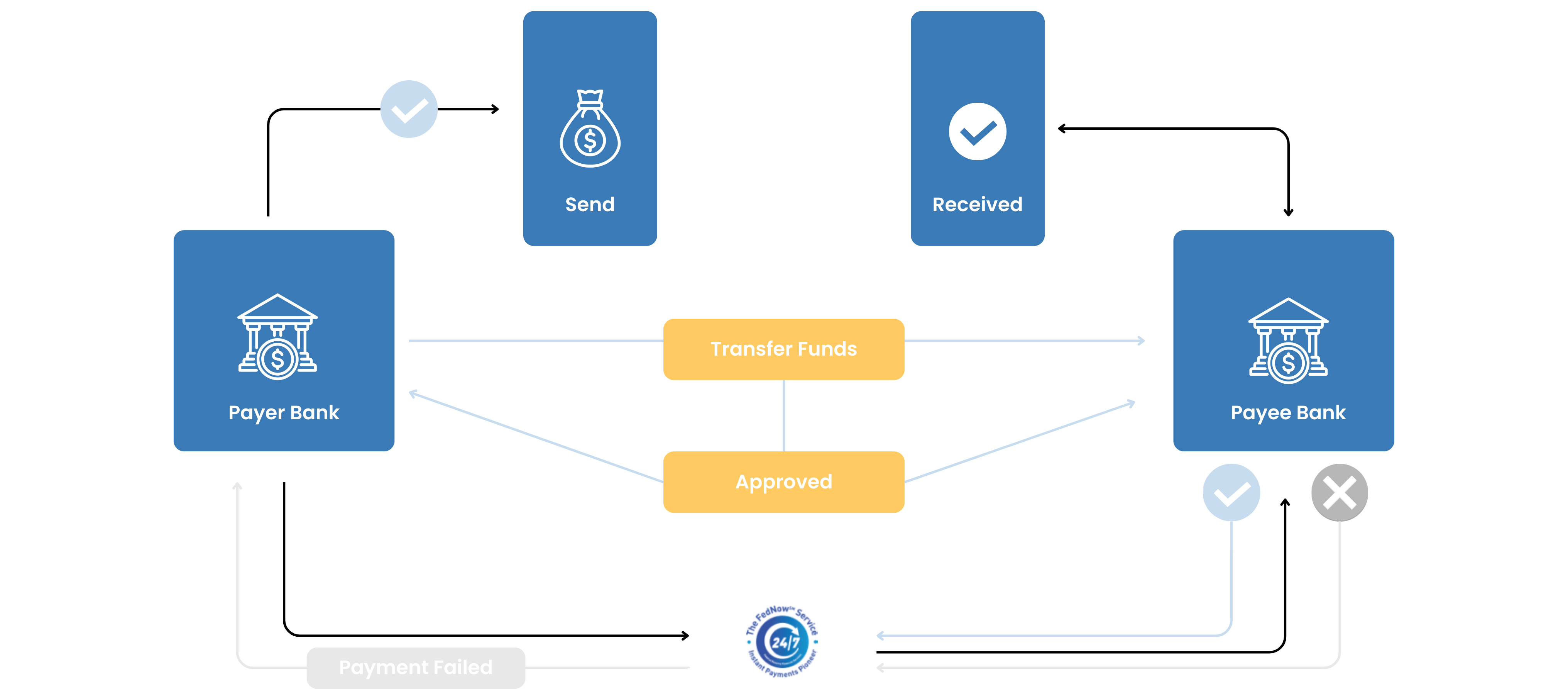

Payments Become Real-Time by Default

In 2026, delayed visibility is no longer acceptable. Businesses expect to see transactions as they happen, not days later. This applies to card issuing, payouts, settlements, and reconciliations.

Real-time payments are no longer a premium feature. They are the baseline. Companies that still rely on batch reporting or delayed settlement struggle to manage cash flow, spot issues early, or make informed decisions. According to a report by ACI Worldwide and Global Data, real-time payment transactions are projected to surge by 63% annually to reach a total of $511 billion per year by 2027.

This shift is pushing payment providers to offer live dashboards, instant transaction data, and faster settlement options as standard, not add-ons.

One Payment Stack Replaces Fragmented Tools

Businesses are moving away from stacking disconnected tools for issuing, gateways, fraud monitoring, approvals, and reporting.

In 2026, the trend is consolidation. Companies want a single payment stack that connects issuing, processing, controls, and data in one environment. This reduces operational risk, removes manual reconciliation, and gives finance teams a clear picture from transaction to ledger.

For growing companies, especially those managing multiple entities or payment flows, fragmentation has become a liability rather than a temporary workaround.

Programmable Issuing Takes Center Stage

Card issuing in 2026 is no longer about simply providing physical or virtual cards. It is about control.

Businesses expect to define how money can be spent, where, when, and by whom in real time. This includes dynamic limits, merchant category restrictions, instant card creation, and immediate card suspension when needed.

Programmable issuing allows companies to align spending directly with internal policies without relying on manual approvals or after-the-fact audits. This trend is especially strong among finance teams managing distributed teams, field operations, or high transaction volumes.

Risk Management Shifts From Reactive to Embedded

Fraud prevention and compliance in 2026 are built into the payment flow itself.

Instead of reacting to chargebacks or flagged transactions after the damage is done, businesses expect risk signals to be evaluated in real time. This includes behavior analysis, transaction context, velocity checks, and rule-based controls that adapt as activity changes.

For high-risk or fast-growing merchants, this shift is critical. Payment providers are no longer judged solely on approval rates, but on how well they help businesses operate safely without slowing them down.

High-Risk Is Redefined, Not Eliminated

High-risk payments do not disappear in 2026. They evolve.

Regulators, card networks, and banks continue to tighten expectations around transparency, monitoring, and reporting. At the same time, entire industries that were once considered niche or risky are becoming mainstream.

The trend is not exclusion, but selectivity. Businesses operating in complex or regulated sectors need payment partners who understand their model, not generic solutions that fail under scrutiny.

This is where tailored underwriting, flexible routing, and proactive compliance support become a competitive advantage rather than a constraint.

Payments Become an Operations Tool

In 2026, payments are no longer owned only by finance teams.

Operations, product, and even customer support rely on payment data to understand behavior, resolve issues faster, and optimize processes. Payment platforms are increasingly designed to serve multiple internal stakeholders with role-based access, custom views, and actionable insights.

The value of a payment system is measured not just by transactions processed, but by how much operational friction it removes.

Infrastructure Matters More Than Features

The most important payment trend in 2026 is subtle but decisive. Businesses care less about flashy features and more about reliability, flexibility, and integration.

APIs, uptime, scalability, and support quality matter more than ever. Companies want payment infrastructure that adapts to their business model, not the other way around.

This is why modern payment providers are focusing on modular platforms, deep integrations, and long-term partnerships rather than one-size-fits-all offerings.

Preparing for Payments in 2026

For businesses looking ahead, the question is no longer which payment method to accept. It is whether their payment infrastructure can keep up with how they operate.

In 2026, the strongest payment strategies are built around visibility, control, and adaptability. Companies that invest early in unified, programmable, and risk-aware payment systems are better positioned to scale without friction.

Payment infrastructure is no longer just about moving money. It is about enabling the business to move faster, smarter, and with confidence.

Back to all articles

Back to all articles

Free Demo with Chris

Free Demo with Chris