Business trips aren’t what they used to be. They’re no longer just about PowerPoints in hotel ballrooms or back-to-back client meetings. Today, they often include team-building dinners, offsite workshops, and activities designed to strengthen culture.

Great for morale? Absolutely. Great for expense management? Not so much.

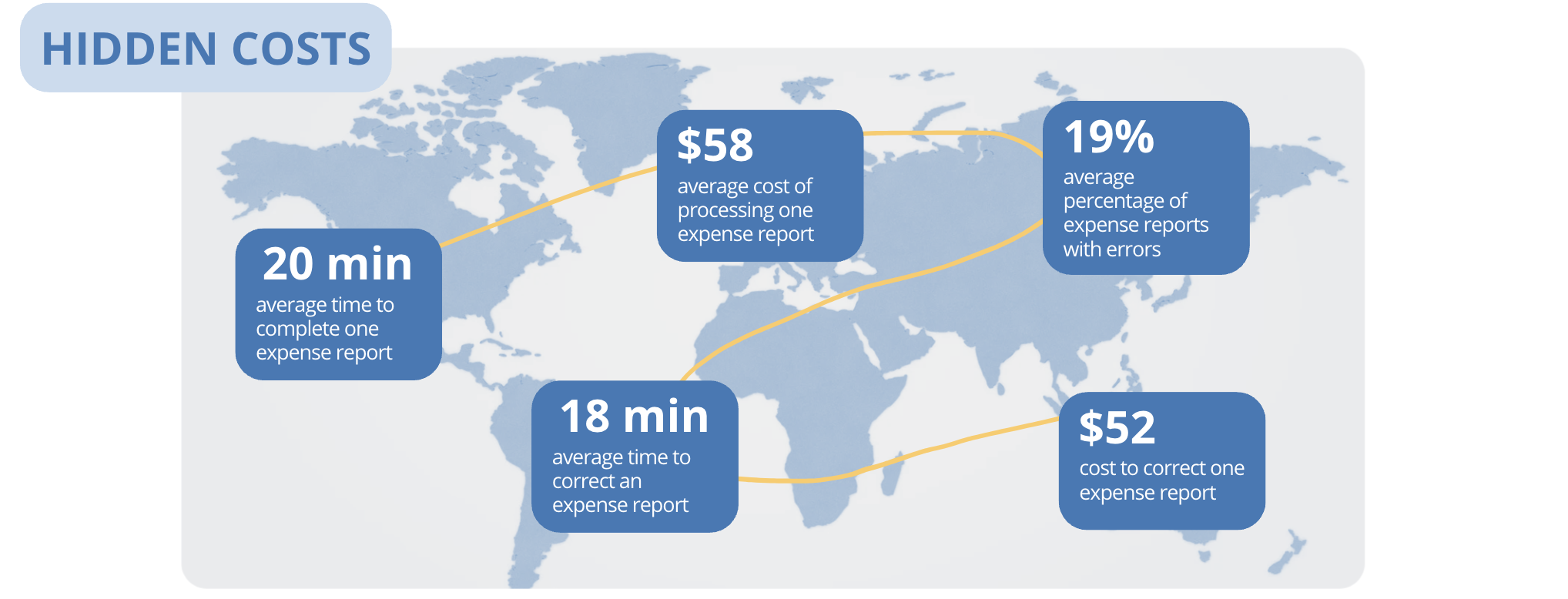

Between last-minute Ubers, group dinners, and hotel charges, business trips can turn into a spreadsheet nightmare. In fact, roughly 19% of expense reports contain errors or missing information, and it costs about US$52 and 18 minutes to correct each one. For the average company doing ~51,000 reports per year, that adds up to about US$500,000 and nearly 3,000 hours wasted annually just fixing mistakes (Global Business Travel Association).

That’s why corporate cards are your real MVP when it comes to trips and team-building.

The Expense Chaos of Business Trips

Let’s picture this:

-

Alice puts the dinner on her personal Amex.

-

Ben books the group taxi from his own Uber app.

-

Charlie forgot the company card at home, so he pays cash for the workshop supplies.

Now your finance team has to decode this like it’s a true-crime podcast. Multiply that across a 20-person team trip, and suddenly “team building” turns into “budget breaking.”

Why Corporate Cards Are Essential

With corporate cards, everyone stays on the same page, literally, in the same portal. Here’s why they change the game:

-

Real-time tracking: Every transaction appears instantly. No more “We’ll reconcile this next month.”

-

Set smart controls: Daily limits, merchant restrictions, and even time-based rules, yes, you can stop that 2 a.m. minibar splurge.

-

Fewer reimbursements: Employees don’t have to play bank for the company. A LinkedIn survey found that 45% of employees have delayed submitting expenses because reimbursements take too long.

-

Finance-friendly reporting: All data is centralized, categorized, and exportable, no forensic accounting required.

Building Culture, Not Chaos

The point of offsites and trips is connection, collaboration, and creativity. If your team is stressed about getting reimbursed for last night’s group dinner, that defeats the purpose.

Corporate cards let you:

-

Pay seamlessly for team-building events

-

Keep budgets clear and under control

-

Give employees peace of mind while they focus on what really matters

And when managed through a provider like TCB Pay Corporate Card Solutions, they also protect your business from overspending, fraud, and unnecessary admin.

Back to all articles

Back to all articles